Planned Giving

Support Nature

What is Planned Giving?

The term planned giving can be confusing. There are many different definitions but the RWLT prefers to take the simpler approach that is easily understood. Planned Giving means a gift made from your savings versus Annual Giving which is a gift made from your income.

With this definition a planned gift can be made during your lifetime or it can be made through your estate. Planned gifts often can be significant so the RWLT encourages all of its supporters to discuss your ideas first with your family and financial advisors and then with the RWLT. The RWLT has many recognition opportunities available for supporters to make a meaningful gift to fund a land acquisition or a program – a few options are listed below.

Lands & Property

One of the most popular planned gifts RWLT supporters can make is a gift of their lands and properties. Maybe family circumstances have changed, maybe your family has left the area or has clearly developed other interests and you want the Trust to preserve your ecological lands in perpetuity. If the lands do not fit with the RWLT’s mission to preserve natural lands maybe the lands, including buildings, would be a valuable addition to our rental properties portfolio. In the past we have had supporters gift lands that do not fit our criteria but with the permission of the donor the land has been sold and the proceeds used for RWLT programs. In all cases a tax receipt is issued for the market value of the property, as determined by an ACCI appraiser, at the time the property is transferred.

Gifts & Publicly Traded Securities

With recent changes to the Income Tax Act any capital gains triggered by the disposition of publicly traded securities is waived if the securities are donated to a Canadian charity. For those supporters that have appreciated securities in their portfolios this is a way to make a meaningful gift, get a charitable receipt for the current market value of the securities while not triggering a capital gain as would happen if the securities were sold outright. Read more about the tax advantages of donating securities below.

Bequests

Bequests are a method of making a meaningful gift. It can be in the form of any asset that the supporter holds at the time of his/her death, a percentage of your estate or a set value. Talk to your financial advisor on ways that you can make a meaningful gift while still providing for your family at the time of your death.

Life Insurance

There are many ways to make a gift of life insurance either in your lifetime or upon your death. Maybe you have a whole life insurance policy that is fully paid that you arranged when your family was younger to assure yourself that your family would be looked after in case of your premature death and circumstances have changed. Your family is now fully independent financially and the life insurance proceeds are not needed for their original intended use. Donate the policy to the RWLT, see your favourite programs prosper and receive a charitable receipt for the value of the policy.

Make the RWLT the beneficiary of a term insurance policy. This can be structured in many ways and in some cases the remaining premiums can be considered gifts to the RWLT and can result in a charitable receipt.

Tax Advantages of Donating Securities

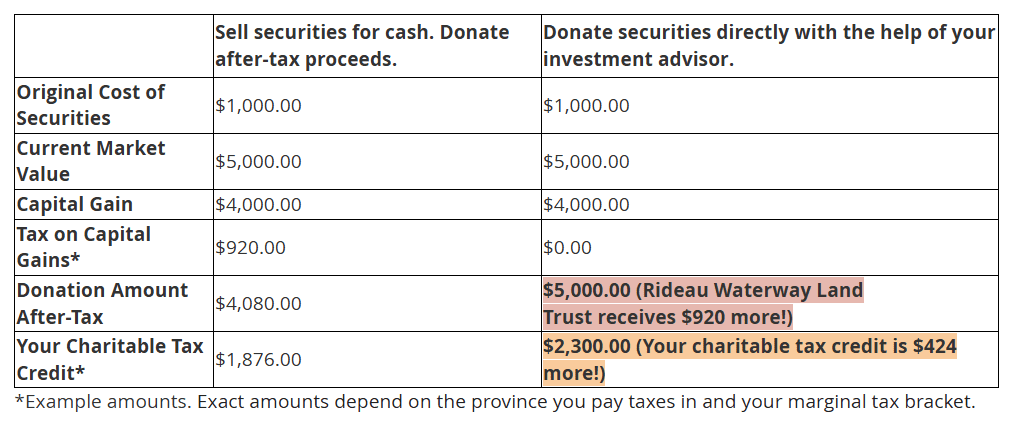

You can make a bigger impact by donating securities and mutual funds. A donation of securities or mutual fund shares is the most efficient way to give charitably. With a donation of securities or mutual funds, capital gains tax does not apply, allowing you to give more and avoid paying capital gains taxes. Learn more about charitable tax credits here.

Let’s say you purchased common shares in ABC Company for a cost of $1,000 and a few years later they now have a current market value of $5,000. You would have a capital gain of $4,000.

The chart below illustrates what happens if you sell the shares and then donate the after-tax proceeds and what happens if you donate the shares directly.

If you are interested in donating securities to the Rideau Waterway Land Trust, speak with your investment advisor and email us at info@rwlt.org.

You can find more information about donating securities on the Canada Helps website.